Europe’s Beer Industry Warns of Lost Momentum as Breweries Plateau

All is not well for Europe’s beer industry since 2019, according to the 2025 European Beer Trends Report by The Brewers of Europe, released recently in Brussels. The report documents a prolonged downturn, with EU beer production sliding from 367 million hectolitres in 2019 to 345 million in 2024, while early 2025 data indicates further declines. Consumption has also failed to recover to pre-pandemic levels of around 320 million hectolitres, hovering at approximately 303 million in 2024 amid falling exports and weakened hospitality sales.

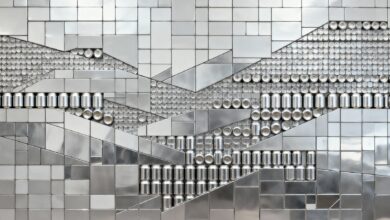

After years of steady expansion, the number of active breweries in the EU has plateaued at around 9,700, with new openings now matched or slightly exceeded by closures, signaling a loss of momentum in Europe’s once-dynamic brewing sector. Low consumer confidence persists as a major drag, reshaping spending habits amid economic uncertainty, inflation, and reduced disposable income for social experiences like pub visits. Hospitality remains severely weakened, with on-trade beer consumption—once about one-third of the market—now accounting for roughly one-quarter, severely impacting the value chain from farmers to festivals.

Non-alcoholic beer continues to be a bright spot amid the downturn, expanding rapidly and now representing 7.5% of total beer consumption in Europe, with growth of about 25% over the past five years. This trend echoes earlier reports on the Swiss beer market, where the non-alcoholic segment surged even as overall beer sales declined. Additionally, the category’s rising prestige is underscored by luxury products like Tom Holland’s Bero, which has gained attention for elevating the non-alcoholic beer experience to premium levels.

Regulations pose a growing challenge for Europe’s brewers, exacerbating the downturn alongside rising costs and economic pressures. Christian Weber, President of The Brewers of Europe, warned that this is not a random fluctuation:

“Consumers have lost confidence and are spending less. Brewers are facing rising costs, tighter regulations and increasing pressure across the value chain. We remain resilient and optimistic by nature, but we need more stability and support to continue believing in a bright future.”

This echoes recent reporting on London pubs, where regulatory hikes from Reeves’ budget threaten to drive up pint prices and further strain hospitality.

Inflation, high input costs, global transport disruptions, and climate-related pressures on raw materials continue to compound challenges for Europe’s brewers, squeezing margins and hindering recovery. Yet perseverance defines the sector, as innovations like Brazilian scientists’ supercritical extraction method demonstrate ways to enhance hop quality and preserve terroir amid climate strains. b33r.xyz hopes and wishes the best to European brewers as they navigate these headwinds toward renewed stability.